Fulton County Occupancy Tax/Short Term Rental (STR)

Any property owner who rents their property on a short-term basis (less than 30 days) must register their property in accordance with the Occupancy Tax Law. The County Treasurer is the collector for Occupancy Tax.

IMPORTANT NOTICE: NEW REGISTRATION & FILING PROCESS

Please be advised that a new electronic system is now in place for registration and quarterly return fillings.

All users — including those already registered — must re-register using the new system.

If you need assistance, please contact the Treasurer’s Office at 518-736-5580.

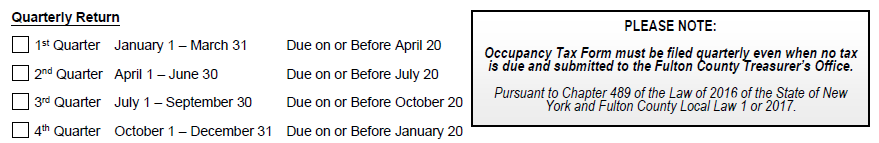

Quarterly Tax Filings & Deadlines

Even if you have no activity during the quarter, a quarterly return must be filed as zero.

To avoid penalties all taxes must be filed before the 20th of each quarter.

1st Quarter:

January 1st - March 31st.

Due before April 20th

2nd Quarter:

April 1 - June 30th.

Due before July 20th

3rd Quarter:

July 1 - September 30th.

Due before October 20th

4th Quarter:

October 1- December 31st.

Due before January 20th

Fulton County does not have a contract with VRBO to collect Occupancy Tax on your behalf.

Treasurer Links